The COVID-19 pandemic sent shockwaves through the global manufacturing ecosystem, but few disruptions were as drastic as the semiconductor supply chain crisis. From automobiles to consumer electronics, industries worldwide came to a grinding halt, exposing just how critical semiconductor chips have become to modern life.

This crisis was a wake-up call for governments globally, recognizing semiconductors as the new “liquid gold.” As Chris Miller highlights in Chip War, each era has been defined by a key driver—first industrialization, then oil, and now, semiconductors. Semiconductors go into almost every device we can think of and with devices getting more sophisticated and smarter, the greater the number of chips it has embedded.

While the world is finally caught up to the importance of semiconductor chips, understanding the semiconductor industry—both from a public market investing and private investing perspective—is now more crucial than ever.

This post is the first instalment of a multi-part semiconductor series covering the intricate world of chips and uncover where the real value lies.

The Semiconductor Stack

Semiconductors are materials that can control the flow of electric current under specific conditions. These materials find its applications in most electronic devices- consumer, industrial, among others.

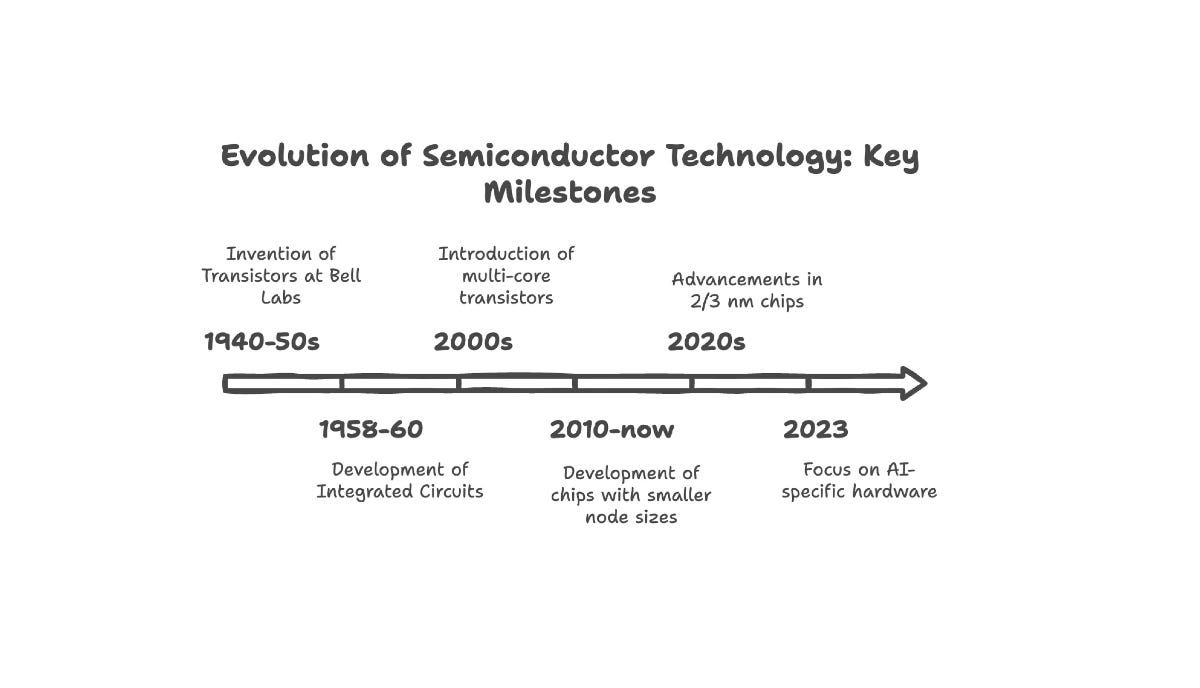

While the early discovery of materials that could control electricity happened in the 19th century, the concept of semiconductor tech was popularized with the invention of transistor followed by the development of Integrated circuits (ICs). Modern computing (the ability to process data or execute instructions), as we know it, would not exist without these.

For the uninitiated, a transistor is tiny electronic switch that can turn electrical signals on or off that helps control the flow of electricity inside a device. Integrated circuit, on the other hand, is a small electronic circuit made from a semiconductor chip, which has multiple transistors and components built into it. An IC can process, control, and manage multiple electrical signals within a device, originating from numerous transistors, resistors, and capacitors. Modern day complex chips have billions of interconnected transistors and as the number of components in an IC increases, so does the number of signals, enabling greater processing power, amplification, or data storage capabilities.

From sand to finished chips, where is the real value created?

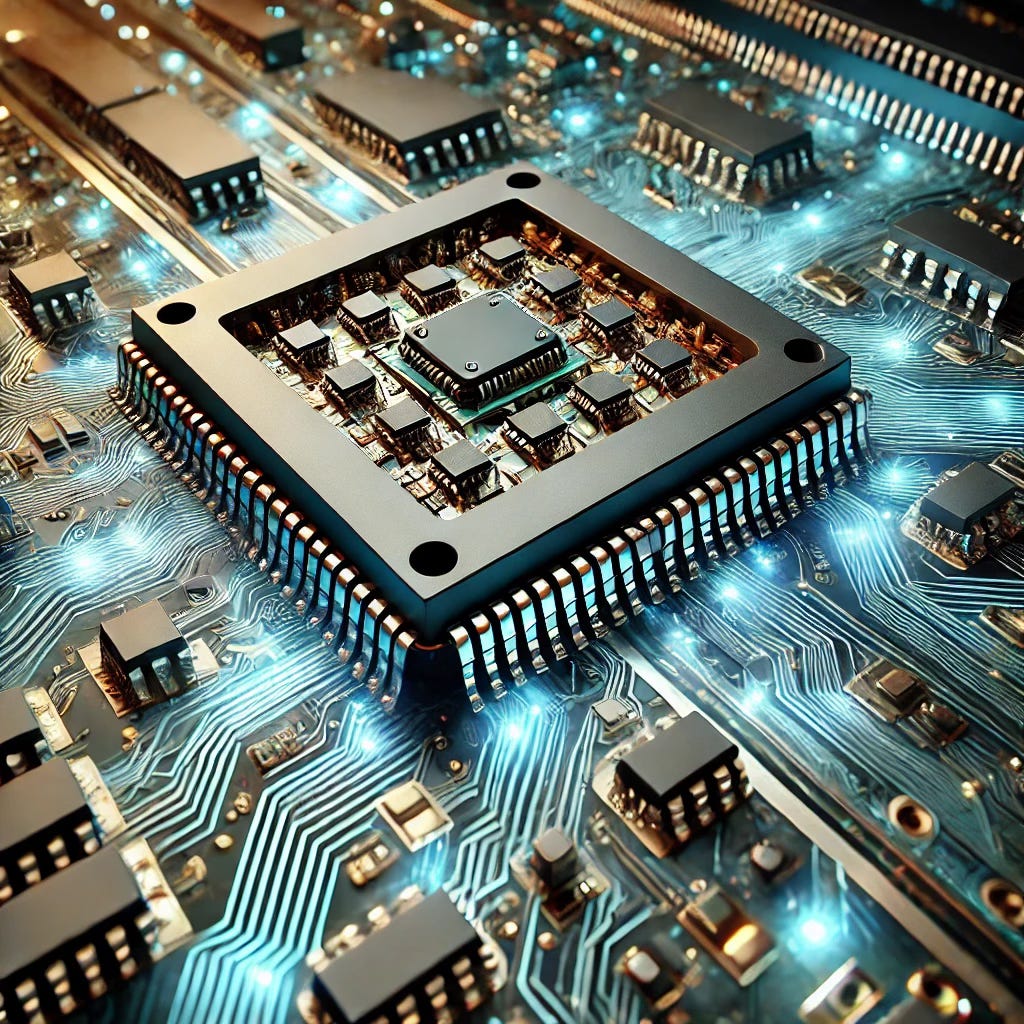

Silicon chips have sandy beginnings. Yes, the same stuff you find at the beach. Silicon which is the backbone of most modern day electronics, comes from this humble material. Through a process of mining, refining, purification and wafering, it is transformed into something that is the foundation of every chip. Turning this into a functional chip requires the process of lithography, etching, doping, thin film deposition repeated over 30 times. The result – a miniature chip that can power everything from a smartphone to self-driving cars.

If all that jargon made your head spin, don’t worry—just check out the diagram below for a clearer picture!

If there’s one prophecy that has shaped the modern world, it’s not from Nostradamus—it’s from Gordon Moore. Moore’s law states that the number of transistors on an integrated circuit doubles roughly every two years, leading to exponential leaps in computing power. And for decades, the semiconductor industry has fit in more and more transistors onto tinier and tinier chips.

However, this exponential growth in compute power has necessitated research into alternative semiconductor materials, from gallium nitride to silicon carbide [since silicon not suitable for all use cases], each offering greater efficiency, speed, or durability in specialized applications.

Semiconductor Ecosystem

The Semiconductor ecosystem like a movie production, has many players and every player has a crucial role. The stars shaping the core product are the fabless chip designers, wafer processing fabs, testing & packaging experts as well as integrated device manufacturers.

But behind the scenes, there are a whole host of players helping the industry run smoothly. Raw material suppliers, design software developers, R&D tool suppliers, manufacturing equipment, clean room and clean room solutions providers- all play their part to make sure the industry operates in sync.

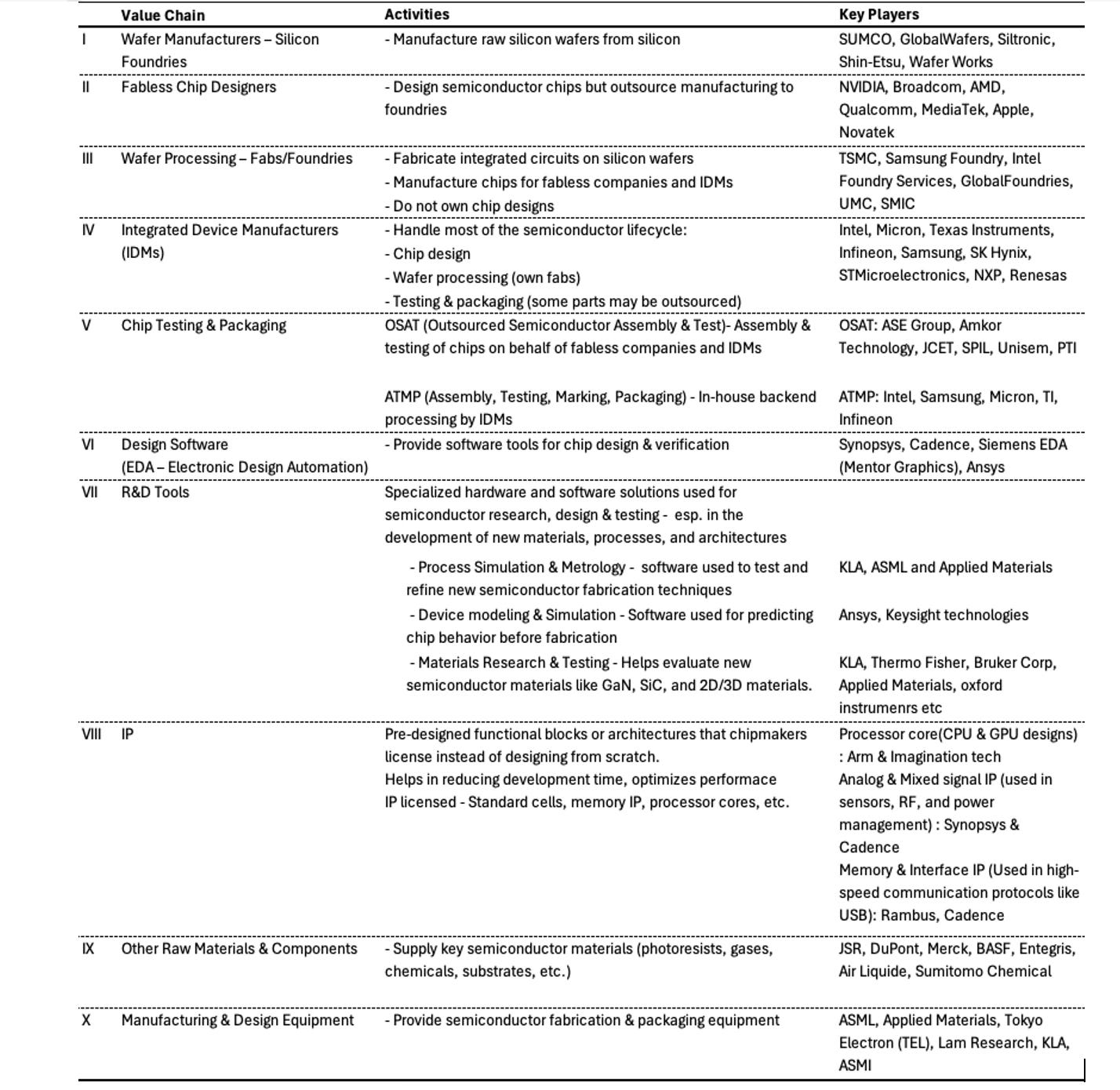

The table below breaks down the semiconductor value chain, highlighting activities and the key industry players.

Continuing with the movie analogy, each character in the semiconductor industry has a distinct role:

The Scriptwriter and the Hero/Director- while fabless chip designers like NVIDIA, AMD, and Qualcomm are like the scriptwriters, coming up with an engaging script for the next technological breakthrough, the chip processing fabs are the heroes/directors who bring these design ideas to life. Without them, even the most brilliant chip designs would remain like words on a page.

The Producer – Just the way a producer funds a production, EDA (tools for chip design) & manufacturing equipment providers like ASML, Synopsys, and Cadence supply the essential tools and technology needed to bring chips to life. Without them, the semiconductor industry wouldn’t exist as we know it today.

The Crew- Similar to the editing, special effects, and post-production work in a movie production, OSAT companies assemble, test, and package chips before they hit the market.

The Extras (Raw Materials & IP Providers): Often overlooked, suppliers of critical IP and raw material like silicon wafers, specialty chemicals, are like the Extras and they lay the foundation of every semiconductor product.

The Distributors : just the way movies are distributed to theatres by film studios, companies like Apple, Tesla & Dell integrate chips into smartphones, EVs, computers among other devices.

Where are the key players located and where is the real value created?

The players in the semiconductor value chain are geographically concentrated, with different regions dominating specific segments. East Asia and China have about 75% of wafer fabrication capacity, with Taiwan and South Korea having advanced chip fabrication (<10 nm) capacity. While Malaysia & Singapore are hubs for assembly and testing, India is emerging as a major player in fabless chip design, Europe specializes in semiconductor equipment and chemical supplies, and the U.S. leads in chip design and IP, EDA (Electronic Design Automation) tools, and high-end manufacturing equipment.

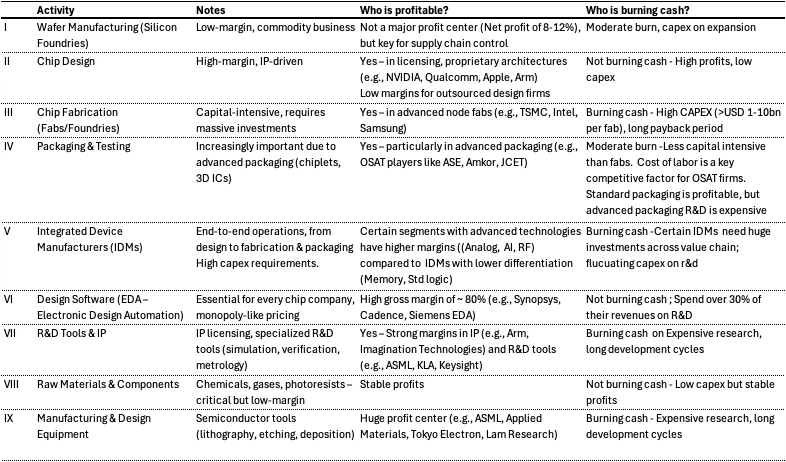

However, not all parts of the value chain are equally profitable. Some segments rake in massive margins, while others are capital-intensive money pits. So, where is the real value being created—and where is cash getting burned?

One glance at the value chain, and it becomes clear where early-stage investors can place their bets and which areas are better suited for deep-pocketed PE players. For VCs eyeing the Indian semiconductor market, fabless chip design is an obvious winner, while raw materials and components present an interesting, albeit less flashy, opportunity.

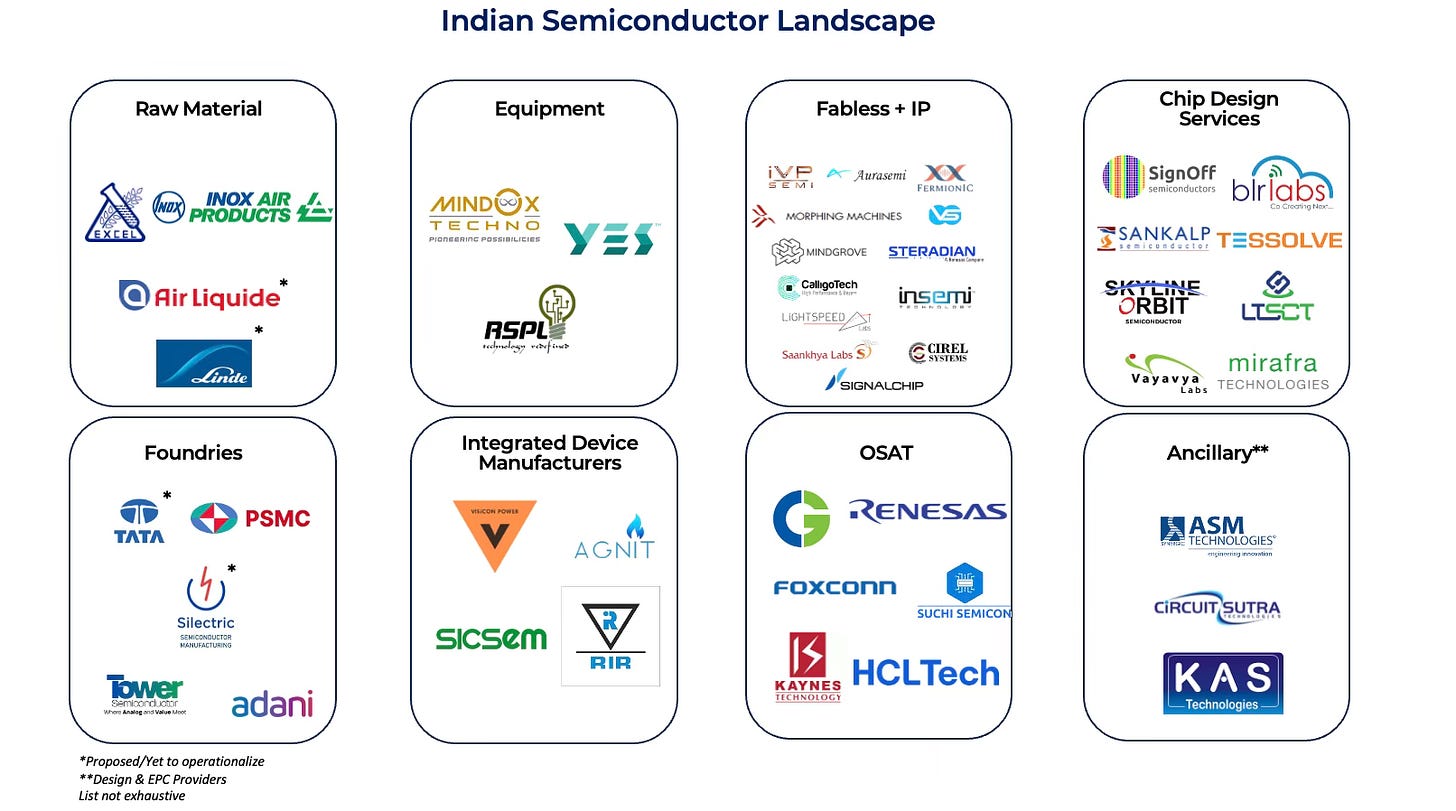

So how does the semiconductor ecosystem in India look like? As seen in the table below, the fabless and chip design segment has a strong presence with numerous players, whereas other segments remain underrepresented, primarily due to high capex requirements.

Production linked and design lined incentive schemes introduced by the government have provided the necessary momentum for both domestic and foreign entrants to invest across different parts of the semiconductor value chain in India. However, when it comes to fabrication facilities and testing & packaging, India is still primarily focused on the basic technologies, while advanced fabrication and testing & packaging continue to be dominated by Taiwanese/Korean/Chinese.

Where else can India carve out a niche other than design? What are the emerging technologies that are being researched in the labs in india? We can explore this more in the series to come.