Ricky Ponting was a literal bunny to Harbhajan Singh in the famous VVS281 Australia tour of India (circa 2001). His scores quite literally read like a phone number he made a total of 17 runs across 5 innings. The Indians went to Australia the next year , Ganguly being Ganguly bought on Harbhajan the moment Ponting turned up. Ponting ran down the wicket and hit Harbhajan over long on for a giant six..something he tried and failed quite miserably in India.

The point I am coming to make is that familiarity may breed contempt but it also enhances your knowledge / experience / efficiency. Now after this cricket analogy lets dive into how and why are we harping on manufacturing as a theme for our fund (a99.vc)

Too Many Wise Gentlemen to spoil the bride!

If you take the Indian startup vc ecosystem , there are at least on last count approximately 1500 vcs in the country. The preferred themes over the last decade is as follows :

Tech Investments – Including SAAS , AI , E-commerce

Climate Tech Investments

Fintech

Deep Tech (this could be part manufacturing)

As we can see we Indians are quite a sucker for IT ITES / E Commerce / SAAS / Fintech (the underlying being tech) now its AI / ML etc. Quite literally every investor and his/her uncle is looking to have a stake in a similar company. Now is that good? yes it is for the incumbent industry / segment however as a fund its not great for investors because of the Chowsky formula.

The Chowsky formula basically says that if you add the total number of investments made in any said segment (IT /ITES / SAAS etc.,) to the total number of companies that are present in the said segment divide it by the cost of one kilo of tomato currently in the vegetable market (not the exaggerated price on Instamart /Blinkit or Zepto) then you get a number which proves as an Investor we are suckers for any foreign/foreigner named/devised formula which doesn’t make any sense! (or maybe I don’t understand it!) [Point in case “Dragon Fly Approach” “LTV ratification” “ XYZ Crucification” “Stockdale Paradox” ]

There is nothing called the Chowsky formula its just something I just made up to show how as a community/humans we tend to think there is logic in anything that is being masked with a foreign name and a formula in its tail.

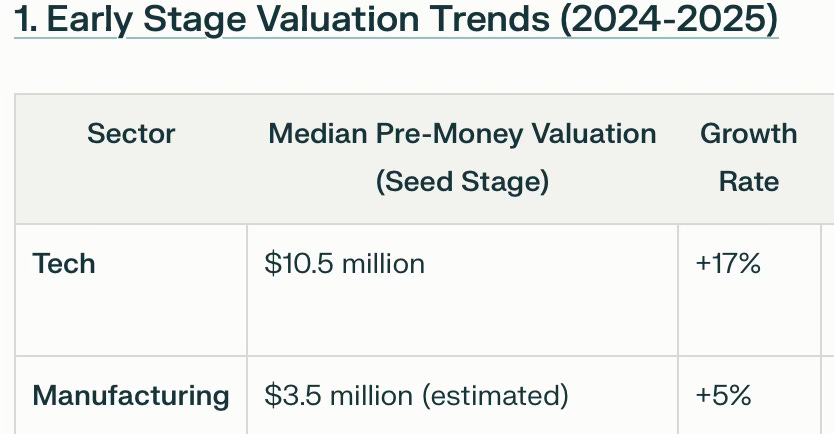

Now back to a basic logical reasoning, when there are only a few pieces of a specific product available in the market but there are umpteen members wanting to buy the same the value of the product without a doubt will go up as members themselves increase their purchase price offered. This is basic economics and buy/sell mentality. Applying the same logic to the venture world. India as a country has potentially 50-100(numbers may vary) businesses that are investable at an early stage whereas there are at least a good 600-1000 investors of varying sizes who want to get into the business. As a result we tend to overpay / offer high valuations for these potential businesses. These high valuations has a trickle down effect on the businesses as well as they are forced to live up to or live up to big expectations which mostly is an uphill battle. Some stats comparing early stage valuations in the manufacturing and tech space given below:

India needs Manufacturing!

It’s great that the IT / ITES behemoths have moved india largely from an Agricultural economy which had been just liberalised to a service oriented / software driven economy. But let’s just not kid ourselves “ WE NEED MANUFACTURING” irrespective what management school educated legendary economists say. I am not comparing us to China to say look at where it got them to (They are not a bad example but!) We need to build scale and cater to both export and import markets. Believe me if we had semi conductor capability during peak COVID we would have named the price and people would have bought. I personally know large foreign MNC CEO’s in the US and UK who left their sophisticated realms and flew down personally to ensure chip supply from Taiwan /Korea / Malaysia.

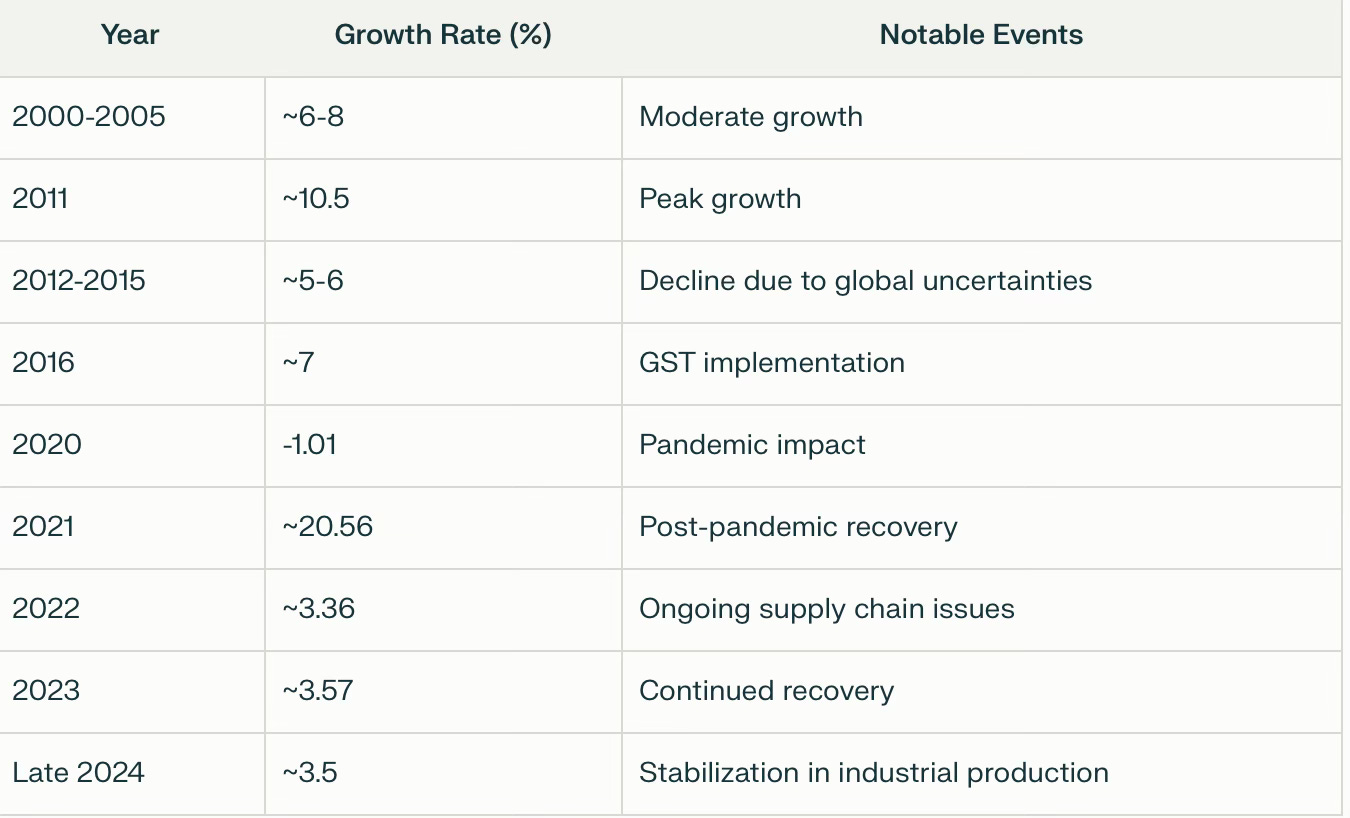

Let’s look at what the data says in terms of where our manufacturing has been growing over the last 2-3 decades

So post moderate growth / peak growth / pandemic drop / subsequent recovery we are still growing only at 3.5% yoy. Though this is stable growth we need to up the ante if we need to get anywhere near the $ 10 Trillion economy.

If we need to hit the $10 Trillion target we need to increase our share of manufacturing in the overall GDP. Currently Indian manufacturing is at 17% of total GDP, our comparison should be Japan and China which are at 20 and 23% respectively.

Next comes the jobs generation from manufacturing. It’s not just enough to generate manufacturing revenue, there should be a cascading effect from manufacturing jobs to have an indirect effect on the consumer and service segments. I have done a basic comparison of manufacturing jobs to total population of India vs the other top economies (Japan / USA / China)

In conclusion, while India’s manufacturing sector employs a smaller percentage (1.27%) of its total population compared to China, Japan, and the USA, it reflects the country’s ongoing development and potential for growth in this sector. We absolutely need manufacturing if we need to hit the bulls eye with both GDP targets and job generation.

The current government in the country also seem to be thinking on similar lines, a recent look at some of the focused initiatives in this space indicate the same:

-

National Manufacturing Mission: A significant announcement is the launch of the National Manufacturing Mission, which aims to support small, medium, and large industries under the “Make in India” initiative. This mission will provide a framework for policy support and execution roadmaps to enhance domestic production capabilities.

-

Financial Incentives : 4-6% financial rewards on incremental manufacturing sales to domestic and foreign entities

-

Targeted Segmental allocation of PLIs: From Mobile manufacturing , Medical Devices, Automobiles and Auto Components, Pharmaceuticals, Specialty Steel

Telecom and Networking Products, White Goods (e.g., air conditioners, LEDs)

Food Products, Textile Products (technical textiles included, Solar PV Modules

Advanced Chemistry Cell Batteries, Drones and Drone Components and many more to come.

Familiarity! Ease of Understanding! Decent Valuations!

“Horses for courses!” “The familiar is by far the most beautiful.” affirmations we say to ourselves when we doubled down on our theme of manufacturing. The thing about manufacturing is the ability to understand the tangible progress and process is an easy attraction for someone from a deep finance background. Also the more easily you understand the business the more rooted the investment decision would be.

Our team at a99 have largely been exposed to manufacturing in some form or another from reading reports as analysts to running manufacturing plants across Asia we are quite at home in the segment. Point in case the Ponting analogy given in the beginning of this long article!

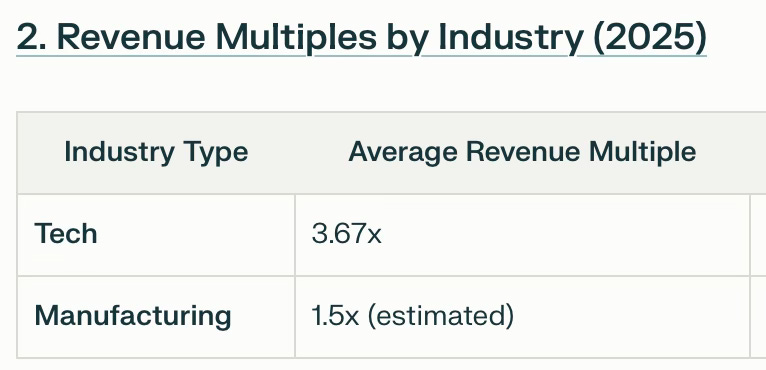

We find the valuations (refer charts given earlier) and the entire process to discuss valuations to be pretty fluid in the manufacturing space. We are not up against multiple term sheets from across the vc ecosystem and forced to make a choice. Profitable companies (yes it’s possible in early stage manufacturing businesses!!) come with reasonable valuations. Early-stage manufacturing companies tend to have lower valuations compared to tech startups due to their reliance on current earnings and tangible assets. The trick is to find a high growth company in the manufacturing space with reasonable valuations.

Equity is not yet the preferred funding mode in Early Stage Manufacturing Companies – Is it an opportunity?

In the current entrepreneurial eco-system in India, a young entrepreneur in most segments is able to find risk capital. As long as the business plans the underlying tech, the potential disruption in the segment is attractive to the investors the early stage companies tend to attract funding. Whereas the same does not hold true for the manufacturing space. Debt funding is the preferred source of funding, this also means collaterals need to be in place. This may include from personal property to wedding jewels. The data set is really skewed for this about 95-98% source funding comes from Debt / Personal Savings whereas a paltry 2% comes from equity or risk capital from investors.

The thought process behind us being on this Manufacturing VC mission is that we want to be the first cheque / early stage investors for these entrepreneurs who are finding their feet in the dust laden difficulty laden manufacturing space. The pay off will take care of itself if the entrepreneur has the execution capability. The macros is going to be conducive to this segment as far as the next decade or two.

There is a clearly established requirement for early stage bets in the manufacturing space and we as a fund are looking to fill the gap.

The Tech opportunity in Manufacturing! (This needs a post of its own!)

This may look like an oxymoron but it’s anything but moronic. Largely in India and a vast part of the world the factories/nerve centre of manufacturing are largely untouched by technology or are very minimally disrupted by technology. The opportunity to introduce technologies such as IOT / AI / Machine Learning / Analytics etc to the factory shop floors is lip smacking and the financial benefits is set to far exceed the investments. Some industry grapevine take aways are given below :

“ A McKinsey survey indicates that 64% of manufacturing respondents reported cost reductions due to AI implementation, while 61% noted savings in supply chain planning costs”

“ Approximately 63% of manufacturers believe IoT applications will enhance profitability over the next five years”

“ Large corporations have achieved energy savings of up to 20% by using AI to optimize energy consumption in manufacturing plants”

“ Predictive maintenance strategies that lead to significant cuts in maintenance expenses of upto 25% by scheduling maintenance only when necessary, preventing unexpected breakdowns”

“ A 15% improvement in production efficiency by utilizing AI for real-time data analysis and process optimization”

“ AI is projected to contribute up to $15.7 trillion to the global economy by 2030, with a significant portion of this growth stemming from increased productivity in manufacturing”

“ By leveraging real-time data for quality control, manufacturers can reduce defect rates significantly. For example, companies implementing AI-based quality assurance systems have seen defect reduction rates improve by up to 50%, leading to higher customer satisfaction and repeat business.”

The above indicated disruptions of the shop floors are not for the future they are very much in the present and is happening rapidly as we speak. The differentiation between the old age conglomerates and the new age manufacturing companies could very well be the effective utilisation of technology. We believe the ideal space for us to invest is in the intersection of core manufacturing (Hard!) and the enablers of tech disruption in the manufacturing space (Soft!).

So What are We saying Finally?

In conclusion, we would like to underscore the urgent need for a strategic pivot within the Indian venture capital landscape, with special emphasis on the manufacturing sector’s untapped potential.

While the tech industry has dominated investment flows, leading to higher valuations and heightened competition, manufacturing presents a compelling opportunity for sustainable growth.

With supportive government initiatives and the integration of cutting-edge technologies like AI and IoT, the manufacturing sector is poised for significant transformation.

By committing to early-stage investments in this area, investors can not only contribute to India’s economic ambitions but also foster job creation and innovation. Embracing this dual focus on robust production capabilities and technological advancement will be crucial in building a more balanced and resilient economy, ultimately positioning India as a formidable player on the global stage.

“ Yad kṛṣyasi tad phalati” – What you plan today you reap tomorrow!

“Yat cintayasi, tat bhavasi.” – What you think you become

“ Ūrjā tatra pravahati yatra dhyānaṁ gacchati” – Energy flows where attention goes!

P.S.: Will look to write a Part 2 where we highlight our work so far in the manufacturing space and the segments where we are looking to invest and potentially contribute to the great manufacturing space that is getting built in India. Also on the cross over between Manufacturing and Deep tech.